In the ever-evolving world of startups and investments, India has emerged as a formidable player, securing its place as the third-largest startup ecosystem in the world, following closely behind the United States and China. As of April 30th, a staggering 98,119 startup entities have been counted within the vibrant Indian startup ecosystem.

At Turbostart, we don't just observe from the sidelines; we're more than mere spectators; we are active participants propelling India's startup revolution forward. With a dedicated investment committee following a sector-agnostic approach, Turbostart is your trusted partner in the journey through India's vibrant world of startups, where innovation meets investment potential.

But what’s in it for you? Through this blog, we're going to take you on a thrilling ride through India's startup universe. We'll also uncover the obstacles these startups face and the road ahead, filled with challenges and opportunities.

Over the past decade, the Indian startup ecosystem has witnessed substantial growth, driven by a strong partnership between the private and government sectors. This evolution is supported by government initiatives, increased access to capital, a growing talent pool, and a culture that embraces entrepreneurship. With startups spanning 56 industry sectors, including IT services, healthcare, and education, India's entrepreneurial landscape has become more diverse and dynamic, making it an exciting journey to explore the evolution of this ecosystem since 2010. Let’s dive into the past, present, and future of Indian startups.

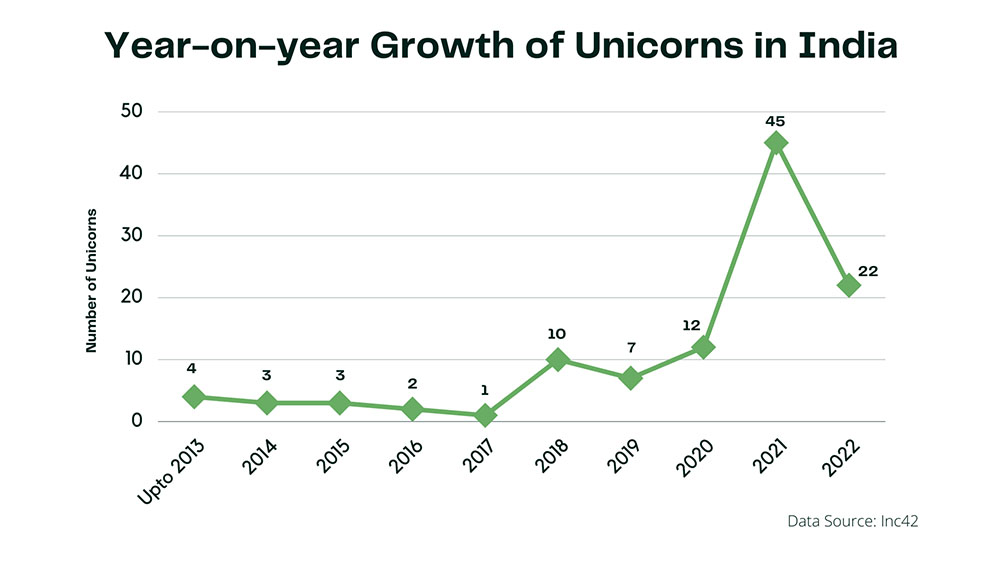

The Indian startup landscape before 2013 laid the foundation for the thriving ecosystem we know today. Just a few hundred startups existed in operation, with the majority concentrated in the IT services, software development, and outsourcing sectors. Consumer-oriented startups in areas like e-commerce were in the early stages of emergence. Only a total of 4 unicorn startups existed when considering a time up to 2013.

Startup support systems, such as incubators and accelerators, were just beginning to sprout, offering limited mentorship and resources. While the government was supportive, it had not yet unleashed the full potential of the startup revolution. The battle for talent was fierce, with startups competing against tech giants for the best minds in India. Navigating a labyrinth of regulations, infrastructure limitations, and a nascent support network were daily challenges.

This era of India's startup ecosystem is a testament to the entrepreneurial spirit, determination, and resilience of those who paved the way. They overcame formidable odds, setting the stage for the remarkable growth and success we now celebrate.

The years spanning from 2013 to 2018 represent a pivotal chapter in the evolution of India's startup landscape. During this transformative era, the ecosystem experienced a substantial surge in entrepreneurial activity, driven by an increasingly favorable environment for innovation. Approximately 7,200 to 7,700 startups emerged during this period, reflecting an impressive 12-15 percent growth rate.

What acted as a catalyst during this period were the various government initiatives and schemes such as Startup India, Fund of Funds for Startups (FFS) Scheme, Startup India Seed Fund Scheme (SISFS), and so on. Their main focus was to introduce a suite of measures to empower startups, including tax exemptions, funding support, and dedicated assistance for incubators and accelerators.

Did You Know? In the year 2019, a remarkable 1,300 fresh tech startups emerged, suggesting that, on average, around 2 to 3 new tech startups were established daily.

Between the years 2018 and 2020, the Indian startup ecosystem experienced significant growth and transformation, marked by several noteworthy trends and developments.

Startups capitalized on the evolving market dynamics, and the ecosystem's robustness was evident through its ability to adapt and thrive in changing circumstances. These years marked a pivotal phase in the Indian startup journey, setting the stage for continued innovation and investment in the years to come.

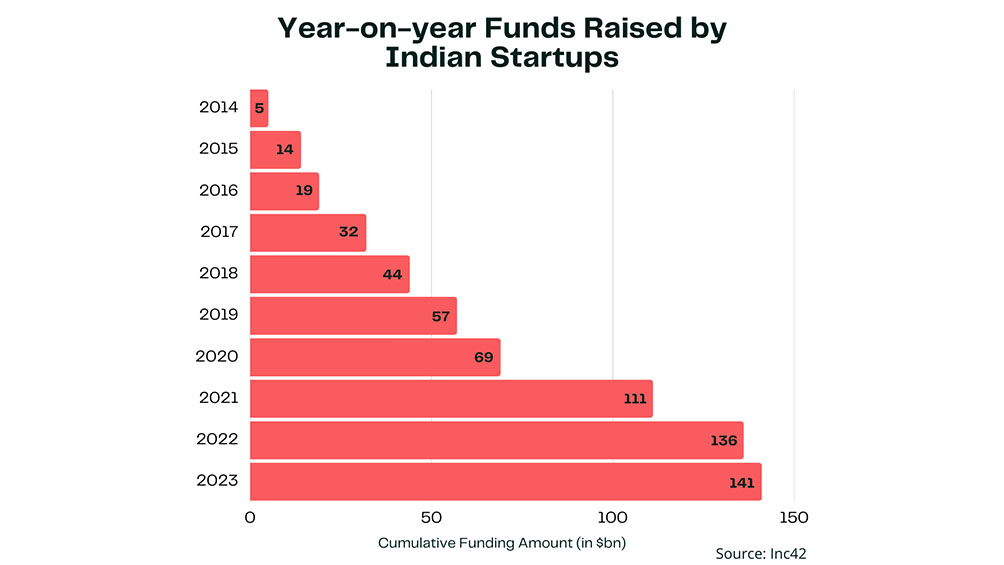

In the post-2020 era, the Indian startup ecosystem has entered a phase of remarkable transformation and growth. Supportive venture capital and private equity funding played a pivotal role, accounting for nearly 40% of the total funding received by startups in 2021-22. This influx of financial support has been instrumental in providing startups with the capital they need to scale their operations, invest in research and development, and explore new markets.

Capital-raising capabilities have continued to be a strong suit for Indian startups, with an impressive $11.3 billion raised collectively in 2020. This substantial amount is a testament to the confidence and belief that investors place in the potential of these innovative ventures. The ability to attract such significant funding has fueled the growth ambitions of startups across various sectors.

Furthermore, Indian startups have capitalized on favorable market conditions in the post-2020 era. The adoption of digital products and services has soared to unprecedented levels, reflecting a growing appetite for tech-driven solutions among consumers and businesses alike. In response to this trend, startups have demonstrated agility and innovation, offering a diverse range of digital offerings tailored to meet the evolving needs of the market.

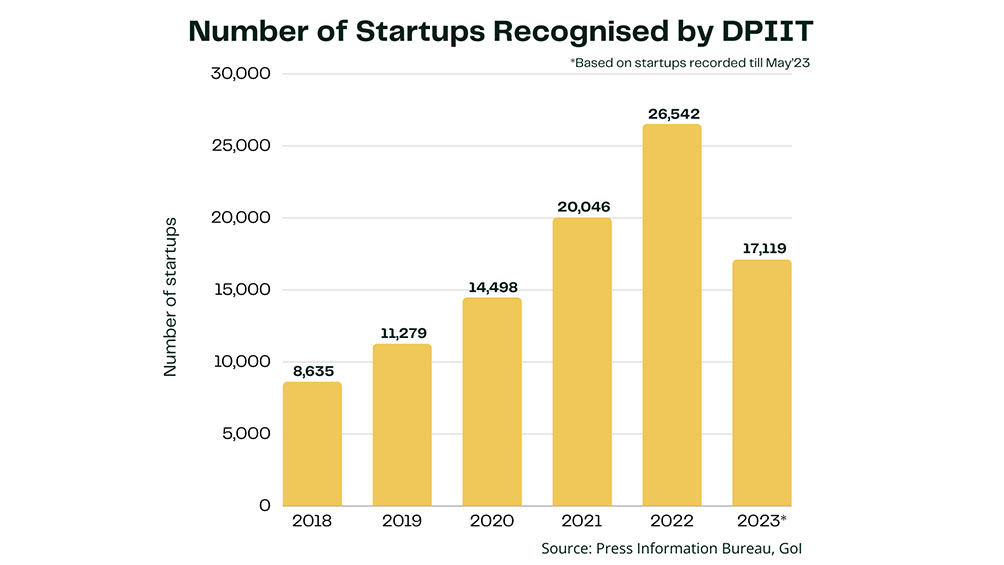

Did You Know? India witnessed a staggering surge of 15,400%, witnessing the number of startups skyrocket from 471 in 2016 to a remarkable 72,993 as of June 30, 2022.

India's vibrant entrepreneurial landscape has witnessed an extraordinary surge in the creation of unicorn startups, marking a significant milestone in the journey of entrepreneurship and investments. As of May 31, 2023, there is a thriving club of Indian unicorn startups, with a staggering 108 unicorns collectively valued at an impressive $340.8 billion, as reported on the Invest India website.

What's truly remarkable about this unicorn phenomenon is the diversity of journeys each startup has undertaken to reach this coveted status. While every startup's path to becoming a unicorn is unique, it's noteworthy that the range of time taken to achieve this feat varies significantly. Some startups have accelerated their growth to reach unicorn status in as little as six months, a testament to their rapid innovation and market penetration. On the other end of the spectrum, a few Indian unicorn startups have patiently persevered for up to 26 years, demonstrating unwavering dedication and resilience in their pursuit of unicorn status.

In the last decade, the Indian startup landscape has experienced an extraordinary transformation. In 2018, India was home to approximately 50,000 startups, with a significant portion—around 8,900 to 9,300—being technology-led ventures. The following year, 2019, saw the birth of an astounding 1,300 new tech startups, illustrating the rapid pace of innovation, equating to the emergence of 2-3 tech startups every day.

The Indian startup ecosystem has warmly embraced the potential of artificial intelligence (AI) and technology solutions. This shift has been further accelerated by the disruptions caused by the COVID-19 pandemic, prompting startups to increasingly turn to AI and tech solutions to meet the evolving demands of businesses and consumers.

A remarkable development within this context is the rise of "GenAI." As of May 2023, India's Generative AI startup landscape has become exceptionally vibrant, with more than 60 startups dedicated to offering innovative solutions across various industry verticals. This surge in the number of startups is mirrored by significant investment, with funding exceeding $590 million, marking 2022 as the year with the heaviest funding inflow.

Furthermore, funding for AI-based startups in India has witnessed an impressive threefold increase between 2020 and 2022, surging from $1.76 billion to a substantial $5.28 billion. This surge underscores the growing importance of AI and tech-driven innovations, reflecting the heightened confidence of investors in the potential of Indian startups in this sector.

In this dynamic landscape, Indian startups in the GenAI domain are gaining prominence among investors, ranking as the third-highest in terms of funds raised in 2022. This trend highlights not only the exponential growth in the number of startups but also the substantial funding inflow in this space, reaffirming the pivotal role of AI and technology in driving the future of Indian startups.

In Turbostart’s portfolio as well, startups like Sivi and Flam are creating disruptions in the GenAI space with their AI powered ecosystem. Turbostart is committed to advancing innovation in the field of artificial intelligence, always seeking new possibilities via engineering solutions. This commitment to innovation is exemplified in two of their remarkable events. The Sparkplug Challenge served as an opportunity for early-stage AI startups and forward-thinking entrepreneurs presenting distinctive solutions. The second, The Great Escape with AI Challenge, was presented as part of Turbostart's Sparkplug event in collaboration with MILES MAHE, Bangalore, and offered the students a chance to explore and commence their journey into the world of artificial intelligence and entrepreneurship.

Did You Know? The Indian startup ecosystem is home to one of the world's largest startup ecosystems, with over 1500 AI-based startups in India with over $4 billion of funding.

In the ever-evolving tapestry of the Indian startup ecosystem, certain sectors are the forefront of transformation, poised to redefine industries and captivate the imagination of entrepreneurs and investors alike. As we delve into the exploration of these emerging sectors, we'll discover the engines that drive India's entrepreneurial future, unveiling the promise they hold for both startups and the world they aim to reshape.

The Indian edtech startup ecosystem is experiencing exponential growth and transformation, presenting a vast market opportunity exceeding $29 billion by 2030. This remarkable expansion is driven by several factors, including the rapid digital penetration, particularly in rural areas, facilitated by affordable mobile devices and internet access. Additionally, the surging demand for high-quality education, government policies, linguistic diversity, and the growing need for upskilling are fueling this growth.

Edtech is revolutionizing education in India through several key facets:

The edtech industry in India is on a meteoric rise, expected to reach $10.4 billion by 2025, with a staggering 37 million paid edtech users. The future of edtech will witness an increasing adoption of technology within existing education systems.

For instance, startups like Seminarroom, Ken42, MentorMind, LearnCab, SpaceBasic, and LXL Ideas, all supported by Turbostart, are revolutionizing academic curricula and providing valuable solutions. These are in the form of skill-based education, providing a unified platform for all institutional needs, real-world mentorship, curated video lectures for professional courses (CA, CS, CMA), automation of everyday tasks for students living on campus, and imparting lessons via impact-led in-school as well as digital experiences. These startups exist as prime examples of the dynamic nature of the Indian edtech landscape as well as its immense potential for investors and innovators alike.

The Indian healthtech landscape is marked by tremendous growth potential. Forecasts predict that by 2025, the industry will reach a valuation of $5.5 billion, driven by a robust compound annual growth rate of 27%. Looking further into the future, the healthtech sector is expected to offer a colossal market opportunity surpassing $67 billion by 2030.

A significant catalyst for this growth is the rapid adoption of Internet of Medical Things (IoMT) and wearable technology. In 2020, this sector witnessed an extraordinary year-over-year growth rate of 144%, highlighting the increasing reliance on connected health devices for monitoring and improving healthcare outcomes.

In recent times, the infusion of innovative digital technologies has given rise to a wave of healthtech startups. These startups are reshaping the healthcare landscape by transforming traditional medical facilities into integrated healthcare hubs. Their focus goes beyond clinical care, extending to enhancing patient engagement through cutting-edge digital solutions.

Startups like Ykrita Life Sciences, one of Turbostart’s portfolio companies, are at the forefront of this transformation. Ykrita is committed to revolutionizing patient care through cutting-edge solutions, with their flagship creation, the Bio-engineered Artificial Ectopic Liver (BAEL), representing a groundbreaking advancement in healthcare.

The Indian startup ecosystem's e-commerce sector is poised for remarkable growth, with projections indicating that it will burgeon into a $400 billion market by the year 2030. This robust expansion is expected to transpire at an impressive Compound Annual Growth Rate (CAGR) of 19% during the period spanning from 2022 to 2030. What's even more striking is the vast customer base this sector will cater to, with over 500 million shoppers anticipated to be actively participating in the e-commerce landscape.

A glance at the historical trajectory of this sector reveals its remarkable journey. Between the years 2014 and June 2023, e-commerce startups in India have collectively amassed an astounding $34 billion through funding activities, a testament to the investor confidence in the sector. The year 2023 has been particularly promising, as e-commerce startups managed to secure an impressive $1.09 billion in funding, accomplishing this feat through a total of 87 deals.

Diving into the various sub-sectors within the e-commerce domain, we find a diverse landscape. This includes B2C e-commerce, Direct-to-Consumer (D2C) models, B2B e-commerce, Re-commerce, Social Commerce, and other innovative models. Among these, the e-commerce marketplace or B2C e-commerce stands out prominently, boasting 11 unicorns that have successfully navigated the challenging startup journey. Following closely behind is the B2B e-commerce market, which houses four unicorns of its own. As of the latest available data, the number of e-commerce unicorns in India currently stands at an impressive 25, illustrating the robust and dynamic nature of this sector within the Indian startup ecosystem.

Emerging players in this space include Meolaa and EyeMyEye, backed by Turbostart. One is a purpose-led platform curating a community of conscious consumers and contemporary, purpose-driven brands; whereas the other focuses on providing affordable eyewear solutions for all eyecare needs. Innovative startups such as these two are characterizing the Indian e-commerce landscape and paving the way for a more socially responsible and economical consumer experience.

In the dynamic landscape of Indian startups and investments, the FinTech sector has emerged as a towering success story. As per the Economic Survey 2022-23, Indian FinTech companies have notched up an impressive 87% adoption rate across diverse user bases, leaving the global average of 64% trailing in its wake.

In addition to their groundbreaking business models, Indian FinTech startups are acutely attuned to the need for operational efficiency to ensure sustainability and profitability. They recognize that optimizing operations is not just a goal but a necessity in the competitive startup landscape.

Projections indicate that the FinTech sector in India is poised to unlock a massive market opportunity exceeding 2.1 trillion USD by 2030. This colossal potential has spurred remarkable growth, resulting in several noteworthy trends:

The Fintech sector in India stands as a beacon of innovation and growth within the Indian startup ecosystem. With remarkable adoption rates, substantial market opportunities, and a commitment to operational excellence, it continues to attract significant investments and shape the financial landscape of the nation.

Out of Turbostart’s investee companies, Leaf Round, Invincible Ocean, and PiChain are in the market providing diverse financial solutions. They provide solutions such as high-return low-risk investment products, automated verification and KYC, digital signatures, compliance, onboarding and screening, and so on. Fintech startups like these are transforming the way financial services are accessed, delivered, and experienced, ultimately fostering greater financial inclusion and innovation.

Did You Know? Volume of UPI transactions in India increased 200x from 4.5 mn in Jan'17 to 10 bn in Jan'23, and the Value increased 600x during the same period.

India's spacetech sector has experienced remarkable growth, now boasting over 140 registered space-tech startups, a significant leap from just five at the onset of the pandemic. This surge underscores the industry's rapid expansion and its burgeoning appeal to entrepreneurs.

Furthermore, the global interest in Indian space startups has been on the rise, with foreign private entities showing keen interest in collaborating with them for launching vehicle applications. This signals a growing recognition of the capabilities and potential of Indian space technology companies on the international stage.

The space industry has shifted towards greater influence from private enterprises, surpassing the dominance of government budgets. Space technology now serves commercial purposes, aiding farmers, improving telecommunications, and supporting renewable energy projects. Engineers from a leading Indian private aerospace manufacturer and commercial launch service provider are developing advanced cryogenic thruster engines. They've already launched India's first private satellite and have plans for another valuable payload launch.

Recent reports reveal that India's spacetech startups have secured an impressive sum of approximately $205 million through more than 30 deals from 2014 to July 2023. This influx of investment signifies the growing confidence in the potential of the Indian spacetech sector.

Since 2020, the Indian government has actively promoted the space sector, leading to the emergence of numerous businesses backed by local research and talent. These startups secured $120 million in investments last year alone, with the annual investment rate on the rise.

Looking ahead, the Indian spacetech landscape is poised for continued growth and expansion. Projections indicate that the total market opportunity in this sector could surge to an astonishing $77 billion by 2030. This projection underscores the immense potential and promising prospects that lie ahead for the Indian space technology ecosystem, making it an attractive and dynamic space for investors, innovators, and entrepreneurs alike.

The agritech sector in India is undergoing a transformative revolution, poised to reshape the country's agriculture industry and bolster the income of farmers. The period from 2013 to 2020 witnessed an astonishing growth in this sector, with the number of agritech startups surging from less than 50 to over 1,000. This remarkable expansion was driven by heightened farmer awareness, increased internet penetration in rural areas, and the pressing need for greater efficiency in agriculture.

Agritech startups are at the forefront of developing innovative solutions that span a wide spectrum of agricultural processes, including precision farming, supply chain management, and establishing vital market connections. These technological advancements hold the potential to substantially enhance productivity, cut down operational costs, and ultimately bolster the earnings of farmers.

As of now, the Total Addressable Market (TAM) for agritech in India stands at a substantial $24 billion. Nonetheless, the agritech sector encountered several challenges, particularly in ensuring that farmers had easy access to crucial farming inputs. In response, the industry swiftly adapted by strengthening its digital content and platforms. This strategic pivot led to a notable surge in the adoption of agritech solutions within farming communities.

Agriculture, serving as the backbone of the Indian economy, contributes approximately 16.5% to the nation's GDP. By 2022, the market value of the Indian agriculture sector had reached an impressive USD 435.9 billion, and it is projected to reach an even more substantial USD 580.82 billion by 2028, growing at a compound annual growth rate (CAGR) of approximately 4.9% from 2023 to 2028. Agritech innovation emerges as a pivotal force capable of addressing long-standing challenges such as inadequate infrastructure, inefficiencies in the supply chain, and historically low levels of digital adoption. These advancements have been holding the sector back from realizing its full potential.

In the dynamic world of Indian startups, trends are more than just fleeting phenomena; they are the driving forces shaping the future. These trends reflect the pulse of innovation, investment, and entrepreneurship in a rapidly evolving landscape. Let’s uncover the key factors and developments that are steering this exciting journey of growth and transformation.

The Indian startup scene is abuzz with a dynamic shift towards sustainability, and it's catching the attention of investors worldwide. Startups in sectors like green energy, health tech, deep tech, and clean mobility are at the forefront of this trend.

Green energy startups are powering India's future with renewable energy sources like solar and wind. Health tech ventures are using tech innovation to make healthcare more accessible and efficient. Deep tech startups are tackling complex problems with cutting-edge solutions. And clean mobility startups are revolutionizing transportation with electric vehicles and smart systems.

To add to this momentum, India can foster globally competitive industries in electric vehicles (EVs), alternative energy, carbon capture, and energy efficiency by providing substantial support and emphasizing startups and research and development (R&D).

Notably, the 2023 Budget has placed a strong emphasis on green technology as a means to attain the country's Net Zero targets by 2070. This underscores India's commitment to sustainability, making it an even more attractive destination for investors seeking profit with purpose.

One of the biggest examples in the renewable energy space is Sheru, an energy storage cloud that offers innovative energy web services, specializing in electrification. They are the first global platform connecting the battery value chain in E-mobility, energy storage, and renewables.

Women entrepreneurs are shattering barriers and adding a vibrant layer to India's startup landscape. The increased availability of education and resources is playing a pivotal role in fueling the ascent of more women entrepreneurs in the country.

What's remarkable is that India boasts a remarkable 43% of women STEM graduates at the tertiary level, surpassing even the United States, Canada, and the United Kingdom.

From 2019 to 2022, a notable 17% of investment deals within India's startup sphere flowed into the coffers of women-led enterprises. This statistic underscores the ascending prominence of women leaders in India's startup ecosystem.

Turbostart itself has a number of women entrepreneurs driving its portfolio companies including Sivi, DOQFY, Ken42, MentorMind, Leaf Round, Sciative, Meolaa, and SpaceBasic, carrying profound implications for the future of our startup terrain. It not only empowers women in their entrepreneurial pursuits but also fosters a more inclusive and diverse startup ecosystem, contributing to the dynamic tapestry of India's entrepreneurial journey.

The evolution of the Indian startup ecosystem over the past two decades has been nothing short of remarkable. Starting in the early 2000s, most startups were primarily focused on catering to the domestic market. Only a handful dared to dream beyond India's borders. However, as time has progressed and these startups have gained traction and attention, a significant transformation has unfolded, driving Indian entrepreneurs to think globally.

This transformation is not merely cosmetic but signifies a profound shift in mindset and ambition among Indian startups. No longer constrained by the limits of the domestic market, these startups have set their sights on the global stage.

In recent years, Indian startups have actively pursued international expansion, capitalizing on their innovative solutions, technological expertise, and competitive cost advantages. Several factors have fueled this newfound global perspective, including increased access to capital, a growing pool of talent, and a heightened enthusiasm for innovation.

The globalization of Indian startups is not confined to a single sector but spans across various industries, including technology, e-commerce, fintech, and health tech. These startups are not only seeking to tap into new customer bases abroad but are also forging strategic collaborations and partnerships on a global scale. Through strategic partnerships, market insights, and tailored guidance, Turbostart works on empowering startups to explore international markets across India, MEA, USA, and Singapore.

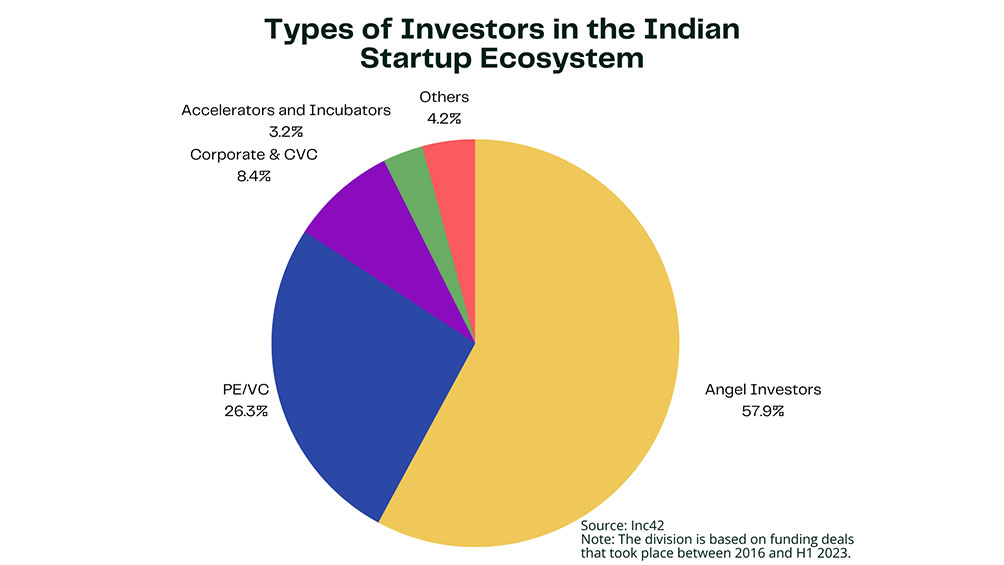

A significant and unmistakable trend within the Indian startup ecosystem is the rapid expansion of the investor base. Currently, there are over 9,500 active investors, and this number is projected to surge to more than 12,000 by 2025 and an impressive 22,000 by 2030.

This surge in the investor base signifies a growing appetite for startups among both domestic and international investors. It reflects a deepening faith in the potential of Indian startups to deliver substantial returns and foster innovation. This influx of capital not only provides startups with crucial funding but also brings with it valuable expertise, mentorship, and networking opportunities.

As the investor base continues to expand, it not only bolsters the financial landscape of the Indian startup ecosystem but also amplifies its global visibility. Investors, both seasoned and new, are recognizing the untapped potential within this dynamic ecosystem, and their presence is catalyzing the growth and evolution of Indian startups across various sectors.

One of the most notable trends shaping the Indian startup ecosystem is the ascent of Tier 2 and Tier 3 cities. These cities, often overshadowed by their metropolitan counterparts, are emerging as vibrant hubs of entrepreneurial activity, presenting a fresh frontier for startup growth and investment. While the startup landscape initially gravitated towards major metropolitan areas, the tide is shifting. Tier 2 and Tier 3 cities are now stepping into the limelight, and this shift is attributed to several key factors.

These cities offer a cost advantage, making them attractive for startups with budget constraints. Lower operational costs, including office space and talent acquisition, translate into a more sustainable business model. The rise of digital connectivity has bridged the urban-rural divide, enabling startups to access a broader consumer base. With the proliferation of smartphones and internet connectivity, Tier 2 and Tier 3 cities have become fertile grounds for customer acquisition and market expansion. Government initiatives and local support systems have played a significant role. Various state governments are actively promoting entrepreneurship and providing incentives to startups that set up shop in Tier 2 and Tier 3 cities.

Additionally, the availability of talent in these cities is on the rise. As education and skill development programs extend their reach, a pool of young, skilled professionals is emerging, providing a steady stream of talent for startups.

The emergence of co-working spaces, incubators, and accelerators in these cities has further boosted the startup ecosystem. These support systems offer mentorship, networking opportunities, and access to funding, nurturing a conducive environment for startups to thrive.

Did You Know? During the week spanning October 23 to 28, 2023, a total of 17 startups based in India secured approximately $339 million in funding. Notably, Bengaluru-based startups took the lead in both the number of funding transactions and the total funds raised.

The Indian startup ecosystem has experienced an unprecedented surge over the past decade, evolving into a thriving landscape with a projected 250+ unicorns by 2025. This growth is further fueled by the nation's ever-increasing population of internet users, expected to exceed 1 billion by 2025, with 750 million users in 2023.

What sets this ecosystem apart is its diversification across various industries, ranging from successful sectors like e-commerce and fintech to emerging areas like healthcare, education, and renewable energy. However, despite these promising developments, several pressing startup challenges lie ahead.

Nonetheless, the Indian startup ecosystem has made substantial progress, offering tremendous growth prospects. To sustain and build on this momentum, it is imperative to address these startup challenges. Overcoming startup financing gaps, simplifying regulations, improving infrastructure, and devising strategies to navigate competition are key steps towards ensuring continued success and fostering opportunities for entrepreneurs and investors alike.

As we reflect on the incredible journey of the Indian startup ecosystem, one thing becomes abundantly clear: India's entrepreneurial spirit is unstoppable, and its innovation knows no bounds. In a world where change is constant, this ecosystem is not just adapting but thriving, proving that it is not merely a part of India's future; it is shaping it.

The journey so far has been awe-inspiring, and as Turbostart continues to pour energy and resources into fueling the growth of startups, we are confident that the best is yet to come. Turbostart extends its support to startups with a comprehensive ecosystem that goes beyond traditional funding from experienced investors. The support is not limited to financial investment; it encompasses mentorship, access to advanced resources, and the potential for global expansion, all designed to help startups thrive on their entrepreneurial journey.

Turbostart offers seed and pre-Series A funding to innovative startups, along with personalized mentorship, access to excellence centers, and a vast network for fostering successful enterprises.